As Gen Z enters the workforce, companies worldwide face a new challenge: how to harness their potential and integrate them into the existing corporate culture.

Gen Z is unique due to their tech-savviness and desire for purposeful work. Despite being inexperienced, they are challenging traditional workplace norms. Gen Z brings a new approach to work, emphasizing autonomy, workplace flexibility, and digital engagement, and their technology adoption is much faster than that of previous generations.

The gap between Gen Z and preceding generations is not just about technology adoption but also their aspiration to question the status quo of traditional power structures and leadership styles in today’s workplace. This article explores how to harness Gen Z’s potential in the fintech sector and discusses the most effective leadership styles to embrace their strengths.

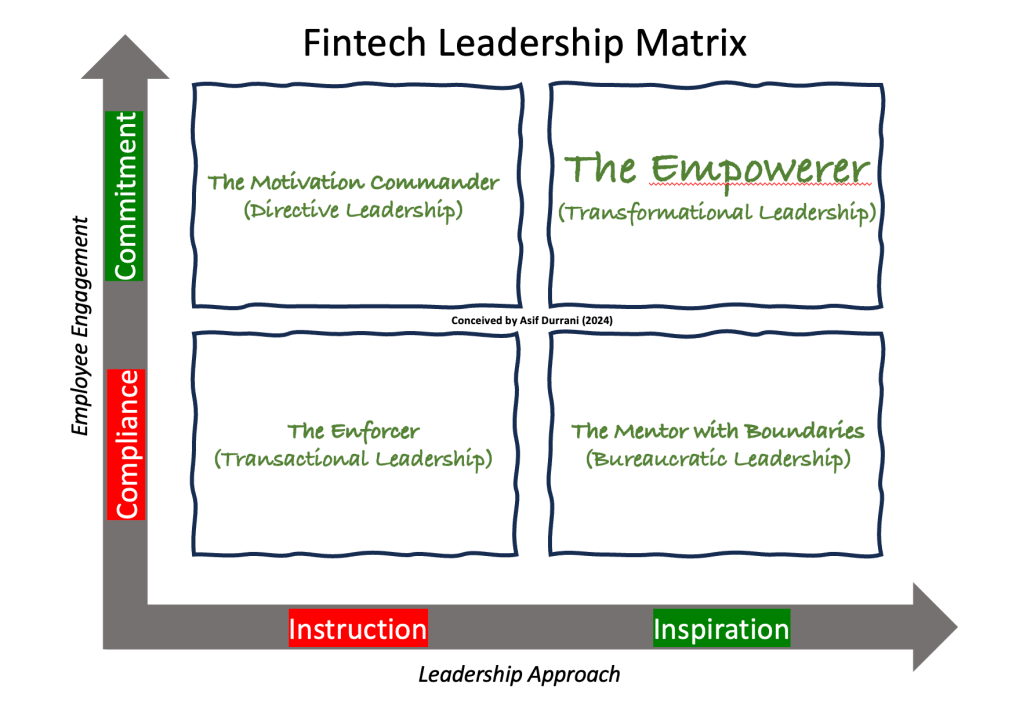

The Fintech Leadership Matrix

To better understand the dynamics of leadership in fintech, I have developed a 2×2 consultant style matrix, The Fintech Leadership Matrix. The matrix is two-dimensional, with Leadership Approach (Instruction vs. Inspiration) on the horizontal axis and Employee Engagement (Compliance vs. Commitment) on the vertical axis. Each quadrant represents a different leadership approach, with implications for employee engagement.

The Enforcer (Instruction + Compliance)

The Enforcer leadership style represents the traditional approach of giving specific instructions and expecting compliance. Workplace engagement and self-initiative are neither recognized nor rewarded in such environments. This style was once effective when consistency and standardization were crucial, as during the Industrial Revolution, but it is too rigid for today’s fintech industry, where rapid change and intellectual stimulation are key.

Numerous studies, including the Self-Determination Theory by Deci and Ryan (1980), have shown that productivity today cannot be measured solely by physical presence. Gen Z, motivated by challenges and purpose, will feel undervalued in a work environment that prioritizes compliance over autonomy, leading to disengagement and high turnover—something fintech companies cannot afford.

This is the red quadrant, and the advice for leaders is: “Stay away from it.” This will not work with Gen Z in the fintech sector.

Leadership Statement: “Do as you’re told to meet the required outcome.”

Leadership Style: Transactional Leadership

The Mentor with Boundaries (Inspiration + Compliance)

The Mentor with Boundaries provides inspiration but still expects adherence to established processes. While this leadership style is an improvement over The Enforcer, it still limits creativity and autonomy, directly hindering innovation, which is critical for fintech.

Gen Z employees are not just followers; they are significant contributors to growth and innovation. Startups like Revolut, Airbnb, and Uber thrive on Gen Z’s understanding of the digital space. While The Mentor with Boundaries may be suitable for ensuring compliance in regulatory matters, it is insufficient for unlocking the full potential of young talent. Relying too heavily on this style risks maintaining the status quo instead of setting new industry standards.

Leadership Statement: “Follow my inspiration, but stick within set boundaries.”

Leadership Style: Bureaucratic Leadership

The Motivational Commander (Instruction + Commitment)

When a leader’s instruction meets employee commitment, it creates the Motivational Commander. This style involves providing clear directives while fostering a sense of responsibility. It can be effective when launching critical products or ensuring compliance in digital payments. However, even with commitment, focusing solely on directives restricts employees’ ability to explore new ideas, which is essential for fintech’s rapid and creative environment.

For Gen Z, understanding the “why” behind an instruction is crucial. While this approach may inspire employees to give their best, it lacks the inspiration needed to fully engage them and stifles curiosity—impacting innovation and creativity, both vital for fintech’s survival.

Leadership Statement: “I’m motivated to do what you instruct and give my best.”

Leadership Style: Directive Leadership

The Empowerer (Inspiration + Commitment)

The Empowerer represents the most effective approach for fintech leaders seeking to unlock Gen Z’s potential. This transformational leadership style inspires and motivates employees while giving them the autonomy to take ownership of their work. Instead of providing detailed instructions, The Empowerer encourages creativity, leading to high engagement and a culture of innovation.

In fintech, empowered leadership is crucial to staying ahead of technological advancements and regulatory changes. Such leaders inspire employees, giving them autonomy, which drives innovation, creativity, and commitment. Gen Z thrives in environments where they feel respected and empowered, and a committed employee is an asset, ready to go the extra mile without rigid instructions.

Kahn’s (1990) study on work engagement highlights the importance of psychological safety and meaningful contribution. Empowered leadership aligns with these principles, providing the environment Gen Z employees need to excel—particularly in a digital-first industry like fintech.

This is the green quadrant, and the advice for leaders is: “Embrace it with open arms.”

Leadership Statement: “Lead me, inspire me, and I’ll own the outcome with creativity and passion.”

Leadership Style: Transformational Leadership

Key Takeaways from the Fintech Leadership Matrix

Fintech leaders must assess their leadership style and determine where they fall within the matrix. The key question is whether they are enforcing compliance or fostering genuine commitment to harness the potential of the young workforce. Here are some strategies for fintech leaders:

- Foster Autonomy in a Regulated Environment: Digital financial services operate under strict regulatory requirements, but that doesn’t mean innovation must be stifled. Leaders should clearly define compliance areas and allow teams to innovate within those boundaries. Psychological safety (Edmondson, 1999) ensures that teams feel free to experiment without fear of punishment.

- Articulate a Shared Vision: In fintech, where the goal is to revolutionize finance and bring seamless payment experiences, employees need to see how their work impacts the broader mission. Articulating this vision effectively ties individual tasks to financial inclusion and digital transformation goals.

- Adopt a Coaching Approach: Gen Z employees value inspiration over direction. Fintech leaders should adopt a coaching mindset, allowing their team members to grow while offering support. This approach is efficient in project-based environments, such as launching new digital financial products, where creativity is crucial.

Conclusion: Leading Gen Z in Fintech with Empowered Leadership

The Fintech Leadership Matrix helps illustrate how leaders can best engage Gen Z talent in digital payments and financial services. As fintech evolves, Empowered Leadership stands out as the most appropriate approach. Moving beyond compliance, fintech leaders need to create an environment of respect, inspiration, and commitment to fully harness the power of Gen Z—a generation characterized by its desire for impact, digital fluency, and innovative spirit.

In an industry built on disrupting traditional financial models, it is only fitting that leadership evolves too. By earning respect, providing meaningful inspiration, and fostering autonomy, leaders can inspire their Gen Z workforce to shape the future of finance, creating not just followers but true partners in innovation.

References:

- Deci, E. L., & Ryan, R. M. (2000). The “what” and “why” of goal pursuits: Human needs and the self-determination of behavior. Psychological Inquiry.

- Bass, B. M., & Riggio, R. E. (2006). Transformational Leadership. Lawrence Erlbaum Associates.

- Kahn, W. A. (1990). Psychological conditions of personal engagement and disengagement at work. Academy of Management Journal.

- Edmondson, A. (1999). Psychological Safety and Learning Behavior in Work Teams. Administrative Science Quarterly.

Author: Asif Durrani

Dated: 02 Oct 2024

www.linkedin.com/in/asifdurrani

Also published at Medium